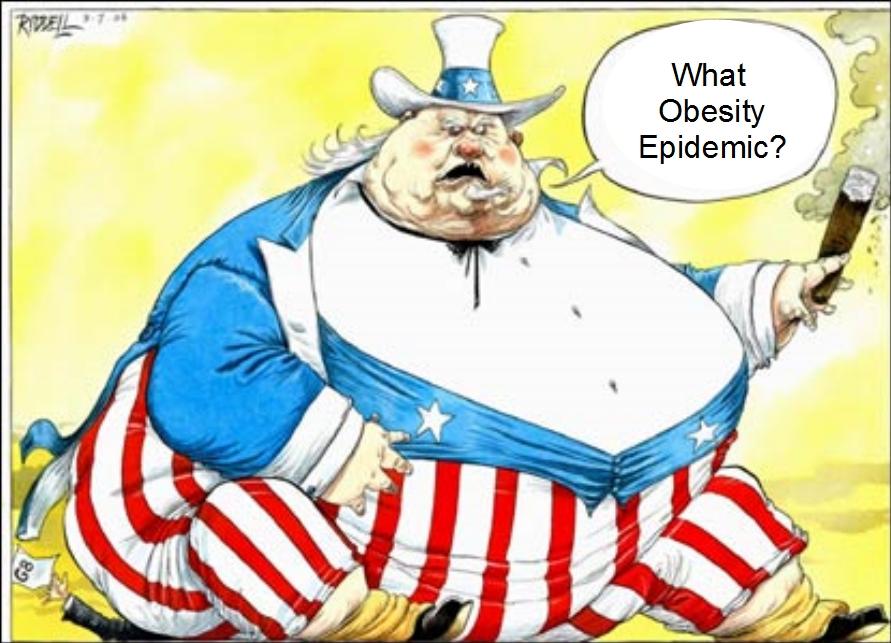

But there is some good news that came out of the election, and the good news has positive consequences for the health of our nation and specifically the obesity epidemic.

As I pointed out in an earlier article about sugar, scientists understand that the current epidemic of obesity is being realized just by the consumption of an extra 20-ounce soft drink each day, on top of the six or nine teaspoons of sugar a day that most people are already eating.

In other words, the overconsumption of sugar is the leading cause of obesity, and soda and sugary drinks are leading the way for many people as the way they overconsume sugar.

The Good News is the Soda Tax

The good news in this election is that four different cities passed soda taxes, much to the chagrin of the beverage industry. In trying to defeat these measures, the beverage industry spent $30 million, while proponents of the tax spent $10 million.

All four cities that voted on soda taxes passed them in landslide victories. Voters in three of the cities that passed measures, San Francisco, Oakland, and Albany, California, approved a penny-per-ounce tax on distributors of sugary drinks. The people of Boulder, Colorado said yes to a 2-cent-per-ounce excise tax on distributors.

“This is an astonishing repudiation of big soda. For too long, the big soda companies got away with putting profits over their customers’ health,” said Jim Krieger, the executive director of Healthy Food America.

Why a Soda Tax

The basic idea behind soda taxes is that s0da is not an essential part of a diet, and by making them more expensive through taxation it will help reduce consumption, improve awareness of the health harms they carry, and nudge people to choose lower- or no-calorie beverages instead.

The United Kingdom, Mexico and Denmark also have similar taxation schemes in place. Each work a little different, but all share a common goal: Raise the price of sugary beverages to drive down the amount people drink and, in turn, reduce the rate of obesity.

Now that these four cities passed these measures, 12 cities and six states are seriously considering taxing sugary drinks.

The fight to tax soda and sugary beverages as a way to combat obesity and promote public health is similar to the fight against tobacco and the drive to tax cigarettes. Increasing the price of cigarettes through taxation was one of the biggest contributors to driving down the smoking rates.

The taxes led to fewer people smoking, and as fewer people smoked, it became less acceptable to smoke. The same could happen with soda consumption.

The money raised from the soda taxes can be used to support other obesity-fighting policies and raise revenue for cash-strapped communities. In Britain, revenue from the drink taxes is funding childhood obesity interventions, such as sports programs in primary schools. In Berkeley, the money goes to children’s health programs in low-income areas that are battling particularly high rates of childhood obesity. Philadelphia’s tax will fund an array of community and education initiatives, including universal pre-kindergarten classes, building new community schools, and improving recreation centers, parks, and libraries throughout the city.

Taxing soda and sugary beverages had been attempted without success by cities and states across the U.S. over 40 times before Berkeley approved a soda tax in 2014, so Berkeley’s approval was a major victory in the fight against obesity. Now with four more cities approving the tax, the momentum is on the side of public health.

After the votes had been counted in the four cities that voted in the soda tax, the American Beverage Association said in a statement: “We respect the decision of voters in these cities. Our energy remains squarely focused on reducing the sugar consumed from beverages — engaging with prominent public health and community organizations to change behavior.”

Don’t Let ‘Em Fool You

Although the American Beverage Association may be trying to make nice by saying they also are for reducing the amount of sugar people consume, don’t let them fool you. They are masters of misinformation and wolves in sheep’s clothing. As long as they are allowed to play in the sandbox with the little chickadees, they will continue to feast on them. The loser in this will be the American public, as obesity rates would then continue to rise.

If we want to improve the health of Americans, reducing obesity should be the number one goal. The best way to do that is to decrease sugar consumption, and a tax on sugary beverages can go a long way towards achieving that goal.

And so, as I said at the beginning of this article, the election of Donald Trump may not be good news for you, but the approval of soda taxes in four cities is. It is the next step in the public health fight to lower obesity rates – that is such a major step in improving the health of Americans.

Another bad news note if you didn’t vote for Donald Trump: He may not have any interest in the fight to lower obesity, as when he assumes office, he will be the first obese President since William Howard Taft in 1908, and only the sixth obese President overall.

Have you read Michael Wayne’s new book “The Quantum Revolution: The Power to Transform?” If you haven’t, you owe it to yourself to do so, as it’s a book that promises to help ignite the movement that is sweeping our society and world, a movement that can usher in a more holistic, sustainable and enlightened world. Go to this link to get your copy now!: The Quantum Revolution: The Power to Transform